The Chancellor of the Exchequer’s Autumn Statement November 2023

On 22 November 2023, in his Autumn Statement the Chancellor of the Exchequer revealed future changes to the following:-

· A reduction in the employee’s National Insurance contributions

· An increase to the National Living/Minimum Wage

· An extension to the employer’s NI relief for employing Veterans.

Employee’s National Insurance Contributions

From 6 January 2024 the rate of employee’s National Insurance contributions will be reduced by 2% from 12% to 10%. For someone on a gross income of £2500 per month that will result in a saving of £29 per month.

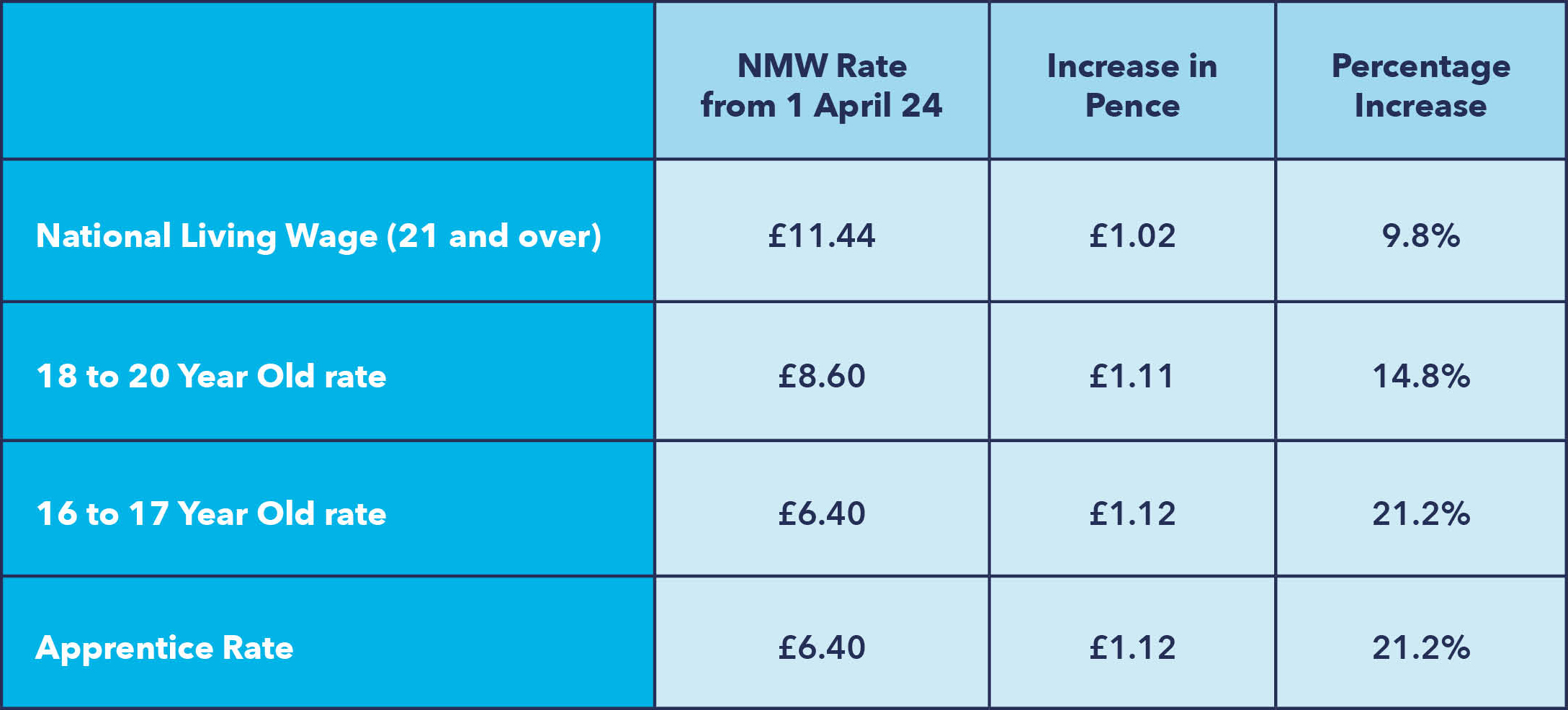

National Living Wage

From 1 April 2024 the National Living Wage will increase to£11.44 per hour for employees aged 21 years and over. The National Minimum Wage rate for 21-22 year olds will be abolished. The updated rates are shown below.

Employing Veterans

The Chancellor announced the intention to increase the time frame in which employer’s can benefit from NI relief when employing a veteran in their first civilian role since leaving the armed forces. The extension will run until March 2025.